How to conduct a competitive analysis

You have a business idea but you're not sure if it solves a real pain point and there's a market of potential buyers out there?

You could move forward and build an MVP to validate your idea but should you really invest the time and money to do it?

Validating that there's enough demand for your solution later down the road is one of the most important steps you need to take in order to build a successful business. As it turns out there's a simple, yet elegant way to figure out if you're onto something.

In this blog post we'll walk through this process step-by-step so that you can make an informed decision whether you should double down or go back to the drawing board.

Ideas and competition

Most of us see competition as a sign of market saturation. If there are too many competitors it's tough to cut through the noise with our very own solution. Old Competitors have deep pockets and will certainly outspent you in their marketing efforts.

Furthermore categories are usually associated with their market leaders. Looking for a solid CRM (Customer Relationship Management) solution? That's what Salesforce is for. Real-time business chat software? Slack is the big player here. E-Mail Marketing? Go with Mailchimp.

While competing with Salesforce might be a bad idea, having competitors shouldn't turn you off as it comes with huge upsides you can exploit.

Having competitors means that the market is already validated. Companies are already spending money for a solution. If you try to enter, let alone define a brand new market you're spending most of your time and effort educating your future potential customers about your product and why it's important for their business to succeed.

It's likely that they're not aware of the severity of the problem you're trying to solve for them. Even if you succeed in educating your future users about your product you still have to raise awareness for the necessity to buy your product in higher management since they usually allocate budgets and therefore have to get onboard as well.

Raising such awareness is a grind which will cost you a lot of money spent on marketing and sales. Money you don't really have if you're starting from scratch with no VC funding. It's way easier to enter a well defined and understood category. A category where a lot of people are already spending money on solutions to solve their problems at hand.

Validating demand

Now that we know that we should embrace rather than avoid competition we can use this fact to do some market research and estimate if there's enough demand for our product. In addition to that we should also check if entering the market is sustainable long-term.

The following 3-step process is a simple, data-driven framework which helps you in answering those questions.

As an example let's say that we want to build a video conferencing tool specifically designed for job interviews done to hire remote employees. Imagine a tool which has built-in support for whiteboarding, code interviews, video playback for mocked-up "stress test" scenarios, facial emotional recognition, recordings, etc.

Should we move forward with that idea? Is there enough demand? Let's run through the process and figure it out!

1. Identifying your competitors

The very first step we need to take is to identify our key competitors. Let's think about how remote job interviews are primarily done these days? What usually happens is that after an initial screening the applicant walks through a series of video calls with various interviewers who vet the candidate based on different criteria.

The core technology used throughout this process is a reliable video conferencing software so let's see who the strongest players are in that market.

To identify the most widely used video conferencing softwares we start our research on a product reviews site called Capterra.

Let's enter "Video Conferencing" in the search bar as we're looking for video conferencing software.

As we can see there's an even more specific category called "Web Conferencing Software" which, based on its description, looks like exactly what we're after. Clicking on the link directs us to the page where we can explore all the web conferencing solutions in use by businesses these days.

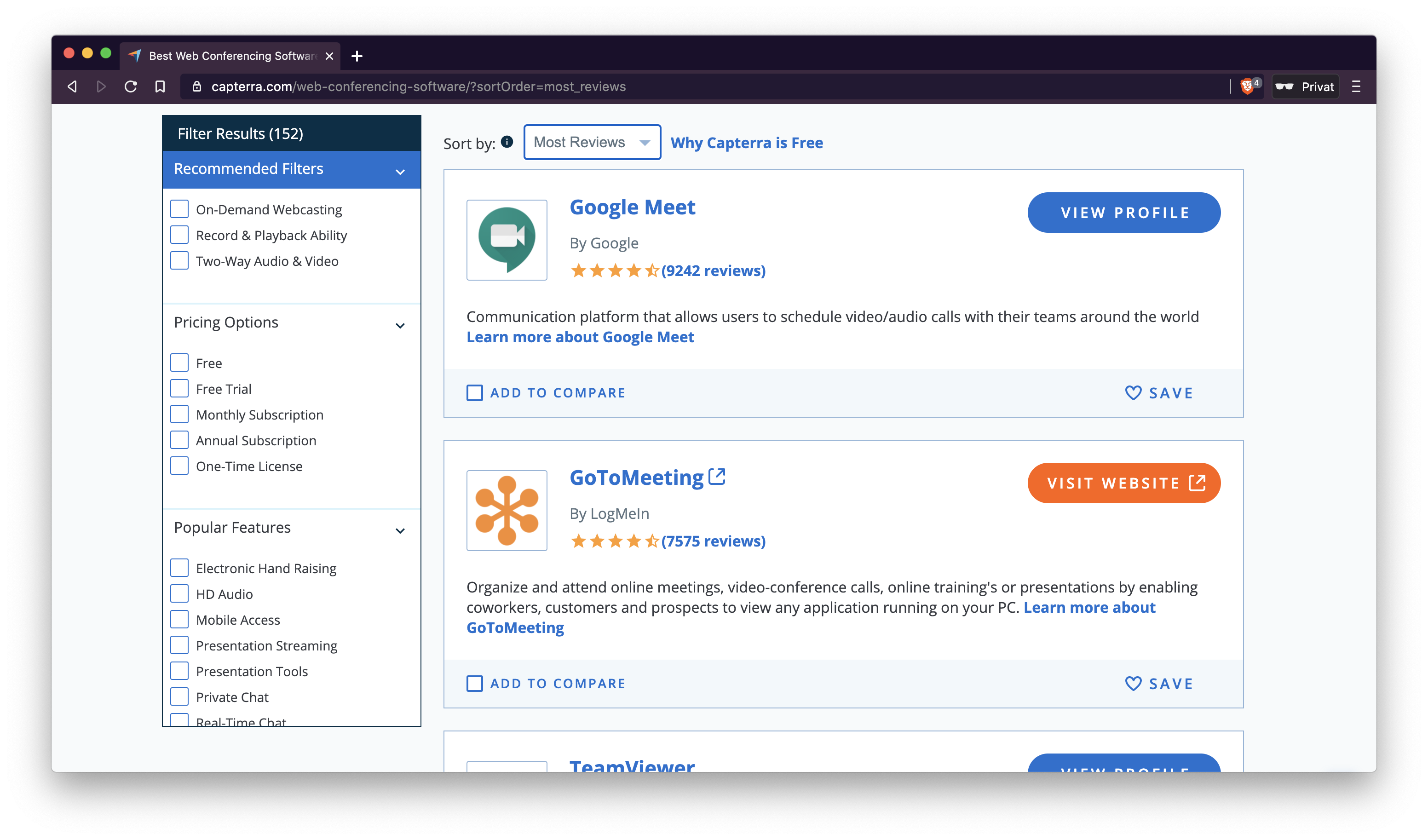

The next thing we want to do is to sort the products by "Most Reviews" because the default ranking includes advertisements at the top.

Next up we take some time to scroll through the list to figure out who our main competitors would be. Skim through the reviews to see which product is often used in the context of the idea you're pursuing (remote job interviews in our example).

After digging deeper into the specifics we can identify the following tools as our competitors:

- Whereby (a.k.a appear.in)

- Wire

- Livestorm

The more time you spend on this step the more competitors you'll uncover. For the rest of this post we'll move forward with these three tools to keep things simple.

A note on finding the main competitors:

When following the aforementioned steps you'll usually find the big names at the very top of the list. In our case that's Zoom, GoToMeeting or Google Meet. That's totally fine and expected. What you want to do is to look for software which is more specialized and tailored towards the audience and niche you're about to serve.

Based on my own experience I can say that a huge advantage for remote job interviews would be a no-login, no-download and no-installation software package (it should be accessible from within the users browser with 1 click). In addition to that, built-in screen sharing and encryption is a must. Those are some of the problem specific characteristics you should take into account to narrow down your competition.

2. The VC funding they raised

Now that we know who our main competitors are it's time to do more research on the companies behind the toolings.

We do this via a website called Crunchbase. Crunchbase is a platform which collects, processes and serves business information about private and public companies with a main focus on venture-backed startups.

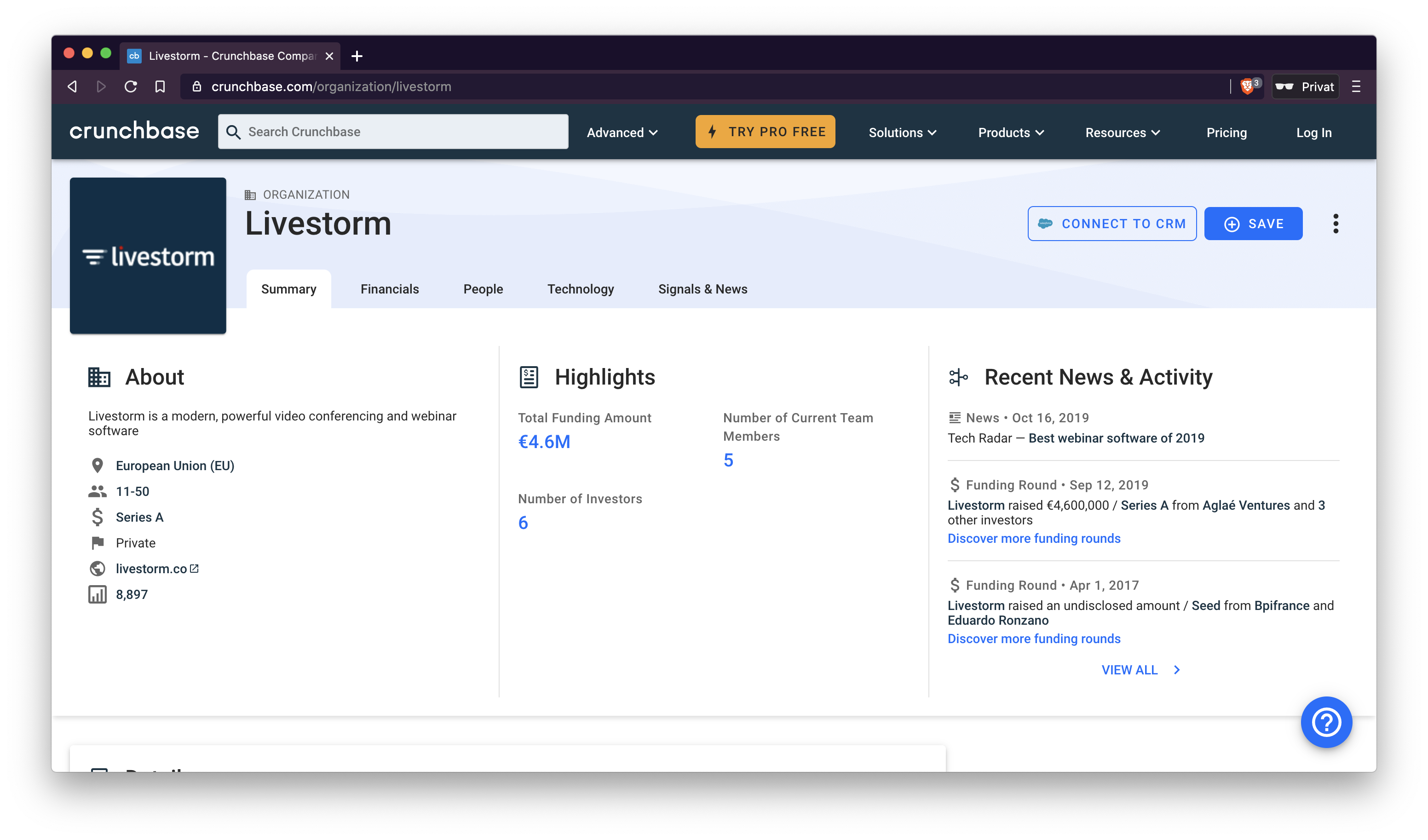

The next step in our research is pretty simple. We enter our competitors name in the search bar and pull up their organizations profile.

What we want to focus on specifically is whether they've raised money in the past and, if so, what amount. In the "Livestorm" example above we can see that they've raised a total of 4.6 Million EUR in 2 rounds (Seed Round and Series A).

We want to do this research for all the competitors we've identified. Simply search for their organizations profile and see if they've raised VC money.

"Wire" for example has raised 14.5 Million EUR and "Whereby" was even acquired by "Videonor".

The main goal with this step is to see if there's money invested in the market. The more money is already invested, the better. Ideally the majority of your competitors should've raised money in the past.

3. Their website traffic

The very next thing we should do is to figure out how much web traffic our competitors are getting.

The more visitors they get, the more demand there is for their product. The more demand, the easier it is for us to grab some of that traffic via paid ads or good content marketing and redirect it to our, more specialized solution.

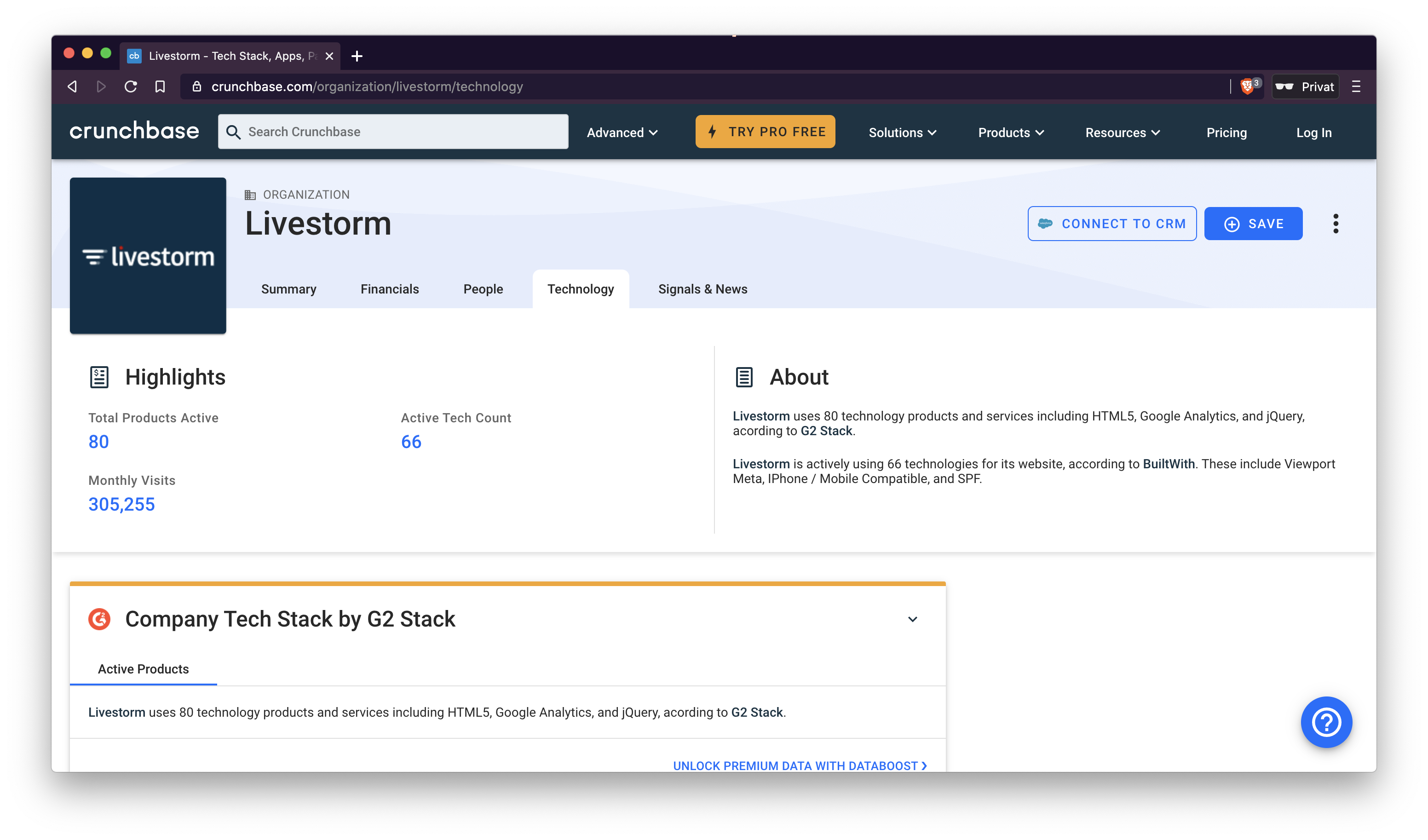

Website traffic numbers are usually considered highly sensitive and kept behind closed doors. Luckily enough Crunchbase has us covered as they're partnering with SEMrush, a tool for professional SEOs and SEMs.

To get a rough estimate as to how much traffic our competitors are getting we can simply click on the "Technology" tab in their Crunchbase profile and look at the "Monthly Visits" number.

Doing so reveals that "Livestorm" gets roughly ~305.255 visits per month. "Wire" sits at ~153.904 monthly visits while "Whereby" attracts ~1.365.524 visits every month.

Again, do this for each and every identified competitor. You should be looking at at least ~150.000 visits per month for each of your competitors. The more, the better.

The results

That wraps up your main market research process. The main objective in doing this research is to validate that there's enough demand such that your new, specialized solution can find its potential customers more easily.

The two signals you want to look for is invested interest in the market via VC funding and enough organic search traffic you can tap into later down the road.

You want to move forward with your idea if you can validate that at least ~4 of your competitors have received funding and are getting more than ~150.000 visits every month.

Your challenge

I'd like to invite you to take some time this week to run through this process with the product you have in mind.

Take the numbers you should be looking for outlined above as ballpark numbers and take other, niche-specific metrics into account (e.g. Facebook followers if you're working on a Social Media related solution).

This process might take quite a while and can feel laborious but trust me that investing this time upfront can save you months, if not years of wasted time and effort.

Conclusion

Starting a new business adventure is a risky endeavor. It takes years and a lot of learnings until success materializes. One of the most common reasons why startups fail is that they solve a problem nobody is willing to pay for.

In this blog post we've discovered a simple 3-step process you can apply to mitigate the risk of building something nobody wants. Via marked research you can validate that there's enough demand to enter the market and carve out your very own niche.

Do you have any questions, feedback or comments? Feel free to reach out via E-Mail or connect with me on Twitter.